Bitcoin, the first decentralized cryptocurrency was invented back in 2008 and has remained the most well known and popular cryptocurrency even today. But, its inventor who’s real name is unknown continues to be elusive. Known only by their pseudonym, Satoshi Nakamura, almost two and a half decades later their real identity still remains a mystery, as does the reason for their secrecy.

Seeking Satoshi: The Mystery Bitcoin Creator is a new Channel 4 documentary series that aims to finally get some answers. Who is Satoshi Nakamura? And why do they seemingly not want to take credit for their invention? While people have claimed to be the Bitcoin inventor previously, Seeking Satoshi looks to put the issue to rest once and for all by finding the real Satoshi.

Stephen Mollah who claimed to be Bitcoin inventor (Leon Neal / Getty)

In the show, Journalist Gabriel Gatehouse sets out to discover the true identity of Satoshi Nakamoto, who seemingly vanished sometime in 2014. Gatehouse interviews well-known hackers and early pioneers of the digital currency, as well as speaking to suspects in an attempt to uncover Satoshi Nakamoto’s true identity.

As well as focusing on Bitcoins inventor, the show also takes a look at why Bitcoin was invented, and the impact it has had on the world as we know it today.

With conspiracy theories indicating that Satoshi Nakamoto might have actually been a group of people, to rumours of dangers from law enforcement and kidnappers. Whether you’re knowledgeable about Bitcoin or not, the show is riddled with mystery and conspiracy theories that will have you hooked.

Journalist Gabriel Gatehouse waiting for interview (NurPhoto / Getty)

If you’re in the UK and want something new to binge, you can watch Seeking Satoshi: The Mystery Bitcoin Creator by streaming it on Channel 4. However, if you’re overseas you’ll be blocked by frustrating regional restrictions. To watch the show overseas you will need to download a VPN, a simple piece of software that changes your IP making it look like you’re in another country.

When choosing a VPN, it’s important to make sure you find one with nodes in the UK, as you will need to access these in order to watch the documentary abroad. There’s currently no information on when viewers in the US, Australia or Canada might be able to watch the show, but until then, a VPN will work fine.

Unless you’re in the UK, a VPN is the only legal way to watch Seeking Satoshi, but, as is often the case with these documentaries, there’s always the chance the rights will be granted to other streaming platforms, making it possible for anyone who doesn’t want to use a VPN to watch it, no matter where they are in the world, but for now, you’ll have to either move to the UK or settle for using a VPN.

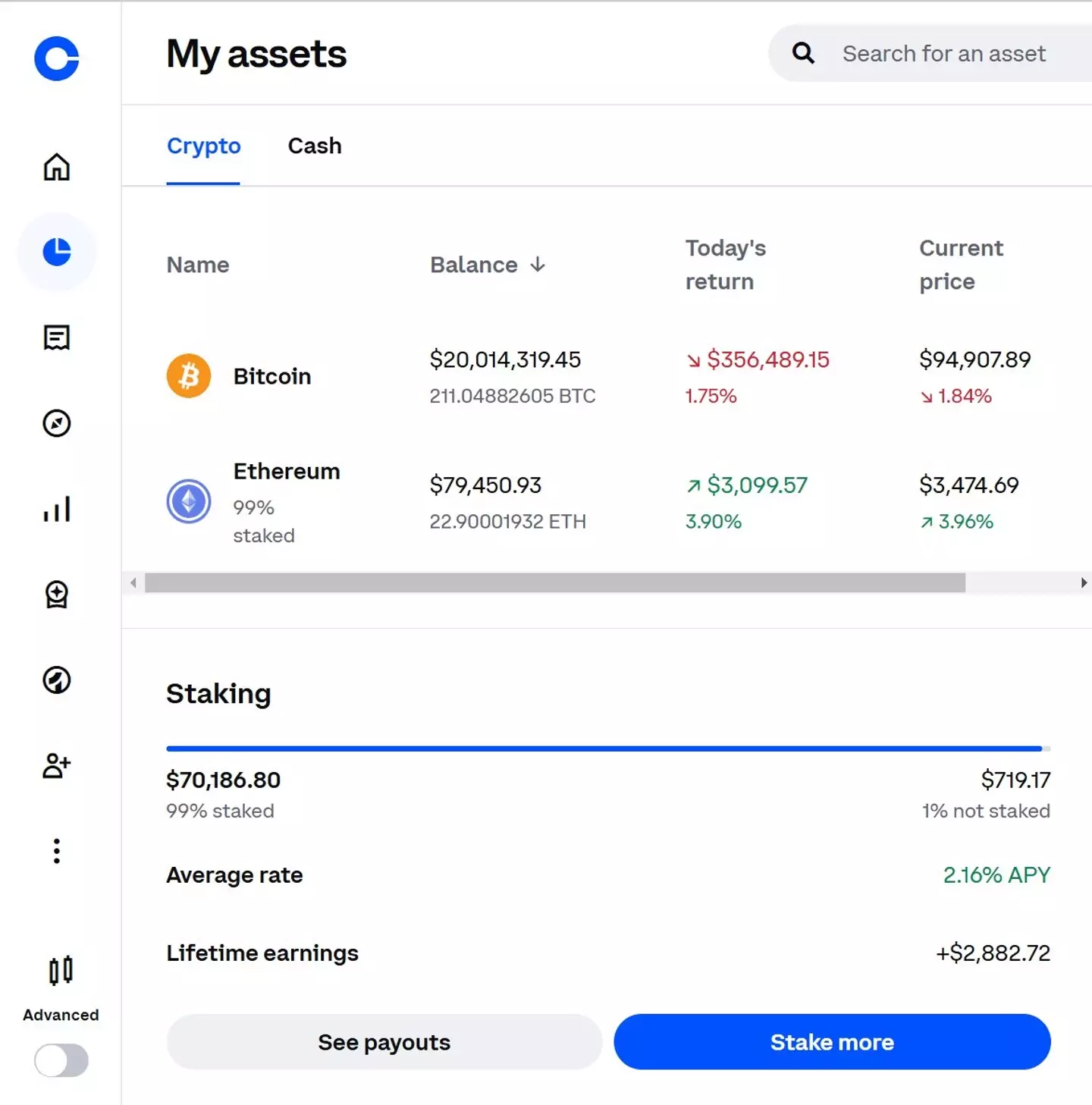

A streamer has shared her eye-watering Bitcoin wallet which is worth $20 million as she asks her fans for advice.

The Twitch streamer known as Amouranth gave viewers a peek into her finances by showing off the contents of her Bitcoin wallet.

The content creator – whose real name is Kaitlyn Siragusa – is one of the most-watched women on the streaming platform.

Amouranth showed off her Bitcoin wallet (X/@Amouranth)

And it looks like her popularity has paid off.

Revealing the eye-watering $20 million sitting in her Bitcoin wallet, Amouranth asked her fans for some advice.

She wanted their opinion on whether she should sell the huge sum or hold onto it.

Bitcoin isn’t Amouranth’s only investment – the streamer also has $1 million in Visa stocks as well as buying multiple gas stations and manufacturing companies.

When showing off her Bitcoin wallet, she also revealed that she has over $74,000 in Ethereum.

And the streamer has a very specific thing in mind that she hopes to spend her money on.

Speaking in a stream with xQc last year, Amouranth said: “I want to take my stream and use that to educate people for animals.

“I wanna have my own sanctuary or work at an existing [one], or I want to be able to work at an existing sanctuary and support it with huge donations. Fund it and help save more animals.

The streamer gave fans the inside scoop on her Bitcoin wallet (X/@Amouranth)

And an animal shelter isn’t the only thing she has in mind – the content creator hopes to one day open a ranch where people can visit to ‘experience ranch lifestyle’ and also ‘save and rescue horses’.

While Amouranth has said that she’ll need to work as hard as she can to make the goal a reality, she also shared that she makes a whopping $1.3 million every month, so it could certainly be in the near future!

A lot of investors are benefiting from a boost in cryptocurrency following the US presidential election.

With Donald Trump’s win, cryptocurrency’s value has been expected to rise and Bitcoin hit a record high earlier this month.

On November 6, it reached over $75,000, with its previous record of just under $74,000 being reported in March of this year.

Trump’s successful bid for the White House has turned out to be good news for people with investments in Bitcoin meaning people like Amouranth stand to benefit.

Those lucky investors who got in on the Bitcoin trend early are now scooping a fortune.

One particular person is Erik Finman who invested $1,245 in crypto at the age of 12, which is now worth a huge $7,543,694.

Crypto expert Tim Draper has made a ‘crazy’ prediction for the future of Bitcoin.

There’s gold in those virtual hills, as American venture capital investor Tim Draper has predicted a meteoric rise in the value of Bitcoin. From its early days from the mind of the MIA Satoshi Nakamoto to Donald Trump being the first U.S. President to buy a burger with Bitcoin, we’ve seen El Salvador adopt it as a currency and people threaten to sue local councils over their missing Bitcoin billions.

In May 2010, the first notable retail Bitcoin transaction traded two Papa John’s pizzas for 10,000 mined BTC. Although that was only the equivalent of around $40, jump forward to 2024 and the rise of Bitcoin means the same 10,000 BTC is currently worth $1,016,935,000.

Bitcoin is projected to continue its upward trajectory (Anadolu / Contributor / Getty)

Bitcoin hit an all-time high of $66,975 in October 2021 before quickly falling by almost 50% in January 2022, but since then, there’s largely been a steady climb. Bitcoin finally surged to a new all-time high of $73,664 in March 2024, then broke the $100k line on December 5. There’s been a mad flurry of activity as analysts predict what comes next, but for Draper, this is the start of something massive.

Speaking to Benzinga, Draper suggested that Bitcoin will continue its upward trajectory to reach $120k by the end of the year: “My first prediction was in 2014 when Bitcoin was at $180. I said that it would be $10,000 in three years. Sure enough, by the end of 2017, Bitcoin hit $10,000.”

Although Draper admitted he was wrong about Bitcoin reaching $250,000 in 2022, he’s still looking into his Bitcoin ball about what comes next. Saying he was three years off with his $250k projections, he added: “I think we can chalk those three years up to a weak government that regulated rather than encouraged new technologies. Our new government is more encouraging.”

It comes after Bitcoin enjoyed a post-election boom with Donald Trump back on the road to the White House. Despite some early skepticism from the former and future POTUS, he’s since adopted cryptocurrency in a big way.

Looking ahead, Draper told Benzinga how Bitcoin is a ‘long-term’ trend: “Bitcoin is just better technology than using banks and governments as the trusted third party. It is transparent, global, open, keeps perfect records, etcetera.”

Hyping the benefits of Bitcoin, Draper continued: “It will make the world wealthier. When retailers (for currency) and governments (for taxes) realize that Bitcoin will save them money on each transaction, then there will be a great incentive for everyone to use Bitcoin.”

Seeing a milestone $250,000 in the not-so-distant future, he concluded: “Assuming a standard supply and demand curve, if there is a big buyer like that, the price will continue to rise. I think 2025 is the year Bitcoin will finally hit my mark of $250,000.”

Even though Draper has been wrong before, there’s definitely a renewed interest in Bitcoin. MicroStrategy co-founder Michael Saylor shared a November post confirming that the company had acquired $5.4 billion worth of Bitcoin – making it the digital currency’s single biggest purchase yet.

Featured Image Credit: Stephen McCarthy/Contributor / OZAN KOSE/Contributor / Getty

A Nobel Prize winner has warned that Bitcoin will be worthless within the next 10 years.

The cryptocurrency boom could soon be over, with one industry expert warning that he thinks Bitcoin might eventually be worthless. After the NFT boom and collapse of 2021, it’s not hard to see crypto going the same way.

There’s been a post-election boom in Bitcoin, with the world’s first decentralized cryptocurrency hitting record highs since Donald Trump trounced Kamala Harris in November 2024. Then again, with Trump being the first US President to buy goods using crypto, we should’ve seen this coming. There’s also the fact that the POTUS and First Lady have released their own meme coins, with both Donald and Melania Trump coming under fire and some losing thousands for investing in them. Trump has made millions off the back of his crypto ventures, but according to Nobel Laurette Eugene Fama, Bitcoin will soon be ‘worthless’. The so-called ‘Father of Modern Finance’ has some stark warnings, suggesting that the cryptocurrency has no real value, is unsuitable for buying and selling, and can’t find a place in normalized banking systems.

Eugene Fama thinks the Bitcoin bubble is ready to burst (Namthip Muanthongthae / Getty)

Fama points out how Bitcoin’s fluctuating prices make it unstable, with many companies (logically) refusing to accept it as payment. Whereas fiat currencies have government support, Bitcoin doesn’t have the backing of a central authority.

Like the previous NFT bubble, Fama suggests that if the demand for Bitcoin vanishes, so does its pricing.

Speaking to the Capitalisn’t podcast with Luigi Zingales and Bethany McLean, Fama explained: “Cryptocurrencies are such a puzzle because they violate all the rules of a medium of exchange.

“They don’t have a stable real value. You know, they have highly variable real value. That kind of medium of exchange is not supposed to survive.”

Zingales went on to add: “The problem with all the cryptos is, in order to create some trust in the system, you basically bound the supply, and once you bound the supply, the price is driven entirely by demand.”

The fixed supply and wavering demand apparently make Bitcoin unsuitable to be classed as a long-term currency.

When Zingales pushed Fama on the future of Bitcoin, and whether it would eventually dip to zero he mused: “I would say it’s close to one.”

Still, he said that ‘the distribution has long tails’, suggesting that it’s hard to predict when, how, and if a collapse will happen.

As for Fama, he actually hopes Bitcoin will go bump, hopefully proving his work on efficient capital markets: “I’m hoping it will bust, because if it doesn’t, you have to start all over with monetary theory.”

No fan of Bitcoin, Fama concludes that for it to stay around long-term, economists will have to overhaul what they think about money and markets completely. Bitcoin hit a record high of $109,114.88 in January 2025, but with prices already slumping due to the market responding to US tariffs, the cracks could already be showing.

Featured Image Credit: Francesco Carta fotografo / Getty

The woman who accidentally threw away her boyfriend’s $630,000,000 Bitcoin fortune over 10 years ago has finally spoken out, and claims that she hopes he’ll find it.

Much like losing a winning lottery ticket, losing track of a hard drive filled with 8,000 Bitcoins would likely consume the life of anyone.

While it mattered little to the owner of the hard drive, James Howells, at the time, as his mining efforts were collectively worth ‘just’ £4 million ($5.07m), the rise in the price of Bitcoin – especially with the surge of cryptocurrency in recent months – has seen it’s overall value skyrocket beyond $600,000,000.

Speaking to the BBC back in 2013, Howells recalls the situation when he lost track of the hard drive in the process of moving house:

“I had a clearout of my old IT equipment – I hadn’t used this drive for over three years, I believed I’d taken everything off it… so it go thrown in the bin.”

Turns out that Howells wasn’t alone in this mistake, as his girlfriend at the time has revealed that she was indeed the one who took the ‘rubbish’ and dropped it off at the tip.

Turns out Howells wasn’t the only one who made the mistake (Wales News Service)

Halfina Eddy-Evans revealed, in an interview with MailOnline, that Howells asked her to bin the hard drive:

“Yes, I threw the rubbish, he asked me to,” she explains, “The computer part had been disposed of in a black sack along with other unwanted belongings and he begged me to take it away, saying ‘there’s a bag of rubbish here to be taken to the tip.

“I thought he should be running his errands, not me, but I did it to help out.”

I bet the pair wish that she had been a bit less generous now.

What remains, over a decade later, is that Howells has switched his begging to Newport Council, as he has spent the last few years trying to get into the landfill which he claims holds the valuable hard drive.

He’s even offered a share of the money to the Council – which is claimed will transform the area into the ‘Dubai or Las Vegas of the UK’ – although his initial offer of a 25% share has since been reduced to 10% with the rising value.

There’s certainly no love lost between Eddy-Evans and her now ex-boyfriend Howells though, as she has argued that “losing it was not my fault,” and has a rather spiteful reason why she hopes that the drive will find its way back to him:

“I’d love nothing more than him to find it. I’m sick and tired of hearing about it,” continuing on to add “not that I want a penny of his money, but it will shut him up!”

Bitcoin is by far the most valuable cryptocurrency right now (VCG/VCG via Getty Images)

I’m sure that Howells won’t mind too much though if it means he gets his hands on the Bitcoin fortune, although he currently remains in the middle of a £495,314,800 ($627,775,410) civil claim against the Council in a last-ditch effort.

Bitcoin has dropped slightly in value over the past week after reaching an all-time high of $99.655.50, but it remains still the most valuable crypto coin by a significant margin.