A financial expert and Nobel Prize winner has issued a harrowing prediction for the future of Bitcoi,n and it’s certainly not looking good.

While cryptocurrency is often in the headlines because of controversial matters, aka Hawk Tuah girl recently, there’s no doubt crypto has seen quite the boom in recent months.

A post-election boost has certainly been a thing in the US, though with Donald Trump being the first US President to buy goods using crypto, we should’ve seen it coming.

The POTUS and the First Lady have even released their own meme coins, which has seen the pair come under fire – but it’s no doubt contributed to its relevance today.

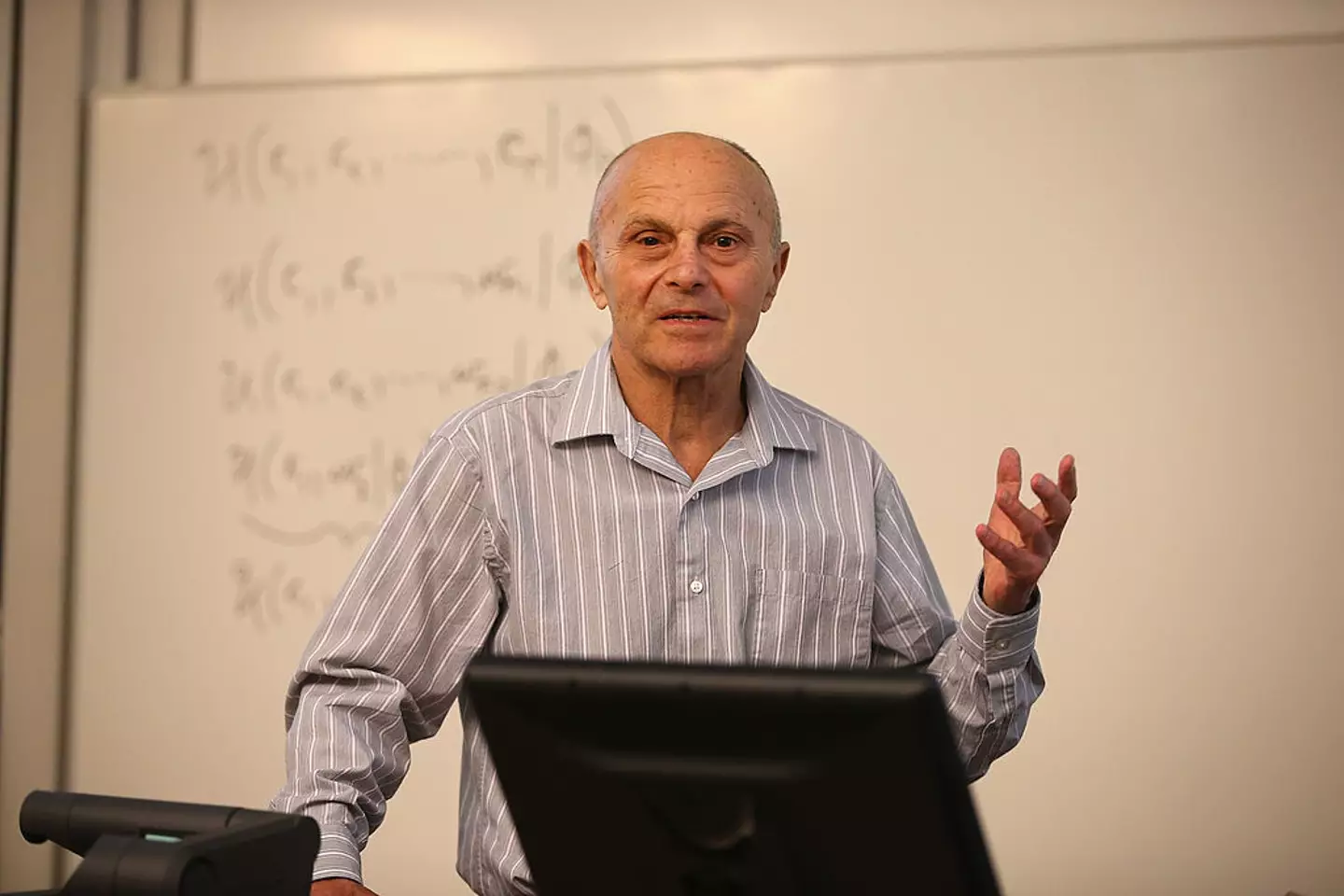

But now, Nobel Laurette Eugene Fama has made a surprising prediction for the future of Bitcoin, claiming it could soon become ‘worthless’.

Bitcoin seemingly has an uncertain future according to the expert (HENRY NICHOLLS/AFP via Getty Images)

The so-called ‘Father of Modern Finance’ has issued a bunch of warnings for keen crypto users, including the fact cryptocurrency has no real value.

While we all know the currency can fluctuate on the whim, Fama pointed out many companies refuse to accept crypto as an actual payment.

To put it simply, Bitcoin doesn’t have the backing of a central authority, while flat currencies receive support from governments across the world.

The expert has suggested that if the demand for Bitcoin vanishes, so does its pricing – and this could ultimately be catastrophic for users.

Speaking on the Capitalisn’t podcast with Luigi Zingales and Bethany McLean, Fama said: “Cryptocurrencies are such a puzzle because they violate all the rules of a medium of exchange.

The financial Nobel Prize winner provided his views (Scott Olson/Getty Images)

“They don’t have a stable real value. You know, they have highly variable real value. That kind of medium of exchange is not supposed to survive.”

The Noble Prize winner added: “The problem with all the cryptos is, in order to create some trust in the system, you basically bound the supply, and once you bound the supply, the price is driven entirely by demand.”

The podcasts hosts pushed Fame on the future of Bitcoin, and whether it would eventually dip to zero.

“I would say it’s close to one,” he said before adding: “I’m hoping it will bust, because if it doesn’t, you have to start all over with monetary theory.”

I mean, if you look at the Hawk Tuah girl fan who lost their ‘life savings’ after investing in crypto, then that really should be a stark warning – don’t just invest your money blindly into crypto unless you really know what you’re doing.

New tariffs announced by President Donald Trump against Canada, Mexico and China resulted in a drop of approximately $300 billion in the cryptocurrency market, and it’s all because of their potential impacts.

Trump brought in the tariffs after he returned to the Oval Office on January 20, where, among other things, he set about tackling what the White House has described as an ‘extraordinary threat posed by illegal aliens and drugs’.

A press release from the White House explained that this threat constitutes a national emergency, and to tackle it the new president has announced hefty tariffs against both neighboring and more distant countries.

Trump announced the tariffs to tackle drug imports (Andrew Harnik/Getty Images)

What are Trump’s tariffs?

In a bid to ‘hold Mexico, Canada, and China accountable to their promises of halting illegal immigration’ and prevent the flow of drugs into the US, Trump has imposed a 25 percent additional tariff on imports from Canada and Mexico, and a 10 percent additional tariff on imports from China.

These tariffs are expected to impact everyday, real-world items such as cell phones, liquor and gas, but they’re also having an impact on the digital world.

Why have Trump’s tariffs impacted the crypto market?

According to Forbes, crypto prices dropped around $300 billion from the combined market in the wake of Trump’s introduction of the tariffs.

Bitcoin alone was down almost 10 percent at its lowest as it plunged overnight from February 2-3, dropping to just over $91,000 before it bounced back to around $95,000 – but that was one of the more positive stories of the crypto impacts.

Ethereum suffered even more as it dropped around 20 percent before recovering slightly, though the crypto Solana, which is a big competitor for ethereum, dropped by just six percent.

Explaining why the tariffs have caused this crash, Nick Forster, Founder of Derive.xyz, told FXStreet: “The recent tariffs imposed by Trump are likely to lead to increased inflation, which could dampen investor sentiment in crypto markets.”

Forster went on to explain that an increase in inflation may cause an increase in interest rates, which historically has been known to result in less favorable conditions for cryptocurrencies.

The crypto market dropped in response to the tariffs (Lam Yik/Bloomberg via Getty Images)

What are other experts saying about the crypto market?

Petr Kozyakov, chief executive crypto payment platform Mercuryo, told Forbes that Trump’s announcement about the tariffs on January 31 unleashed a ‘tidal wave of fear, uncertainty and doubt’ across the cryptocurrency market.

“The prospect of prolonged higher interest rates has rattled all global markets,” he said. “While bitcoin has dropped below the $100,000 mark the King of Crypto is once again proving itself to be in a class of its own in marked contrast to altcoins bleeding dark red across the board.”

Joining the discussion, investment expert Jeff Park took to Twitter to argue that the tariffs might actually prove beneficial for bitcoin in the long run.

In a post on the platform, he wrote: “Tariffs might be just a temporary tool, but the permanent conclusion is that bitcoin is not only going higher—but faster. While both sides of the trade imbalance equation will want bitcoin for two different reasons, the end result is the same: higher, violently faster—for we are at war.”

A team of hackers have finally unlocked a $3 million Bitcoin wallet after a man forgot his password for 11 years.

I mean, forgetting your password is certainly a pain, but it’s usually not the end of the world.

But to forget your password for a whopping $3 million Bitcoin wallet? Well, that is pretty devastating.

Thankfully, however, security researchers have cracked a password to recover the massive amounts of money after it had been stuck in crypto wallet for 11 years.

You’d want to make sure you’d never forgotten the password to a $3 million wallet (Getty Stock Photo)

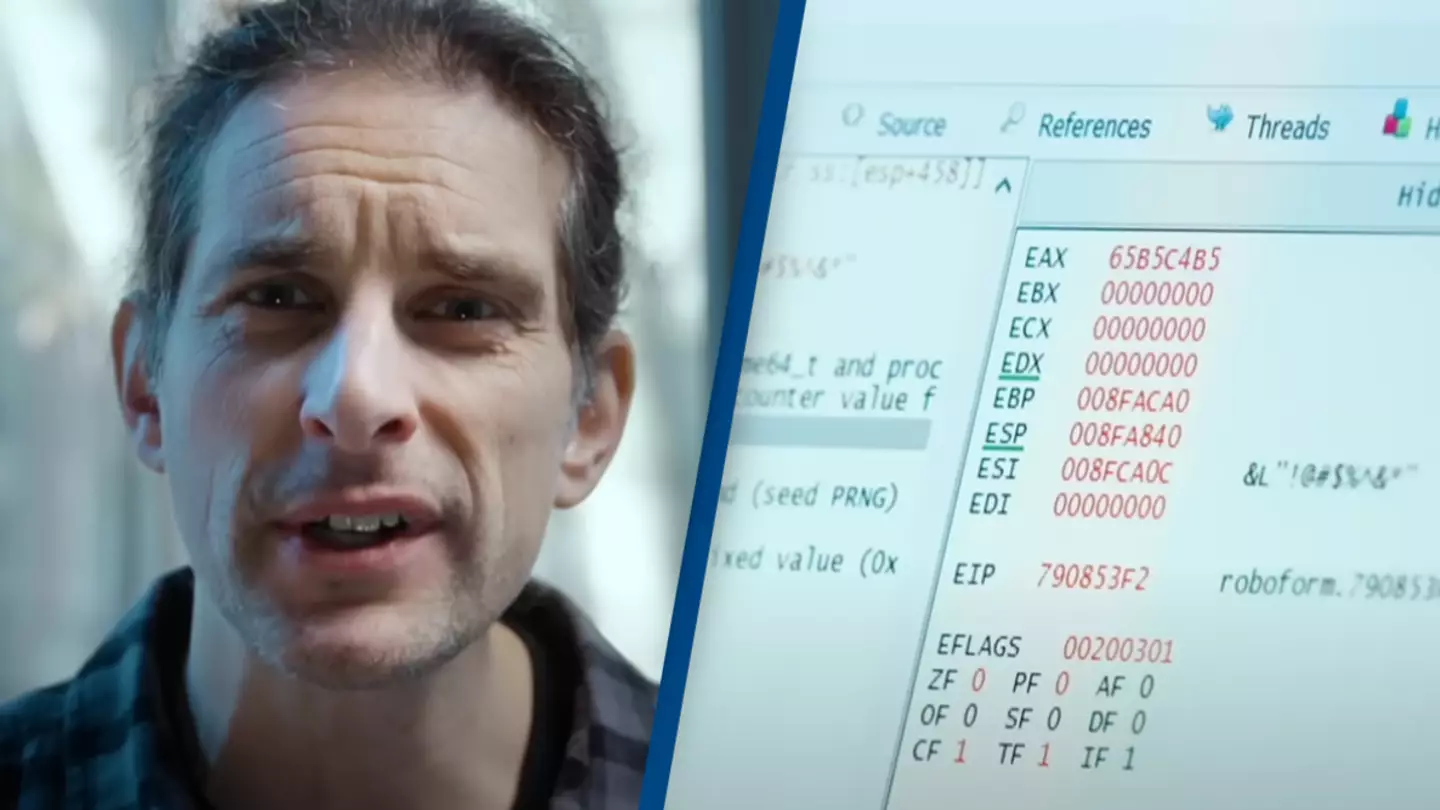

Electrical engineer Joe Grand, who goes by the handle ‘Kingpin’ online, was hired to hack into an encrypted file holding 43.6 BTC.

The high worth of cryptocurrency was protected by a password created by a random password generator called Roboform – but the password had since been lost.

The anonymous owner worried that someone would hack his computer and obtain his password – ultimately gaining access to his cryptocurrency.

“At [that] time, I was really paranoid with my security,” he said.

So, the owner asked Grand for his help, after he became known in the community in 2022 for helping another crypto owner recover access to over $2 million in cryptocurrency he thought he’d lost forever.

Grand says dozens of people have previously contacted him to ask for help with recovering lost treasure.

Joe Grand to the rescue. (YouTube/Joe Grand)

However, Grand decided to turn a lot of them down for various reasons, but decided to help this particular anonymous owner with his quest.

In a YouTube video published by Grand, the wallet’s owner said: “I generated the password, I copied it, put it in the passphrase of the wallet, and also in a text file that I then encrypted.”

At the time of the owner losing access to the account, the Bitcoin worth stood between $3,000 and $4,000.

But as the price of bitcoin had risen by more than 20,000 percent, the owner decided to reach out to Grand.

So, Grand used a tool developed by the US National Security Agency (NSA) to disassemble the password generator’s code.

He said: “In a perfect world, when you generate a password with a password generator, you expect to get a unique, random output each time that no one else has.

“[But] in this version of RoboForm, it was not the case.

“While RoboForm’s passwords appear to be randomly generated, they’re not. With the older versions of this software, if we can control the time, we can control the password.”

Grand was able to trick the system by changing the time back to 2013 when the password was generated, and after a few failed attempts, it ultimately led to the same password being recreated.

The hacking expert then worked with his colleague Bruno to generate millions of potential passwords.

He was able to eventually crack the code – which Grand said to Wired was ‘ultimately lucky’.

“We ultimately got lucky that our parameters and time range was right. If either of those were wrong, we would have … continued to take guesses/shots in the dark.” he told them in an email.

The internet is divided by how much a man paid for a restaurant experience after leaving a physical Bitcoin on a table.

Bitcoin (BTC) is defined as a form of digital currency (cryptocurrency) which is used for encrypted, peer-to-peer transactions and operates independently of a central bank.

Because Bitcoin usually exists in cyberspace, it’s highly unlikely that you’ll ever see a coin in the wild.

But physical BTC does actually exist and, according to Crypto News, it could be worth more than its value depending on what it’s made out of.

Some physical coins are 3D printed onto plastic or metal plating while others are stamped onto metals including gold, silver and brass. But regardless of its material, the currency looks and feels like an actual coin and – if you’re lucky – could be an actual collectable.

One Redditor has revealed he is now in possession of physical BTC and has taken to social media to debate whether it’s one of these sought-after coins.

Physical coins released by a Bitcoin user named Casascius and another called Lealana are popular with auction houses and collectors – with some selling for up to $360,000.

Taking to the popular ‘Mildly Infuriating’ thread on Monday (October 28) the Reddit user, known as Martoshka, uploaded an image of a coin.

Beside it, they wrote: “A guy left this on the table of the restaurant I work in and left without paying.”

Fellow social media users have swarmed to the thread to have their say.

A restaurant employee was given a physical Bitcoin (Reddit/Martoshka)

One commented: “Lots of those were sold with associated wallets that actually had funds on them.

“Don’t throw that away until you’ve had a few (trusted) friends familiar with the tech check it out to make sure you’re not throwing away money.”

They added: “I’m not saying it’s certain or even likely, but imagine how you’d feel if dude came in next week and was like ‘So how did that 10 grand change your life?’ and you’re like ‘Wait that actually had value on it?’.

A second, however, wasn’t so sure and joked: “You can buy one on Amazon for a couple of bucks.”

“Is there an unpeeled sticker on the other side? If so, don’t be too hasty to throw it away, just in case,” someone else remarked.

A fourth typed: “As someone who collects these it’s a ‘Mini Brands’ toy collectable meant for kids. Got mine for 1€ few weeks ago.”

“Unless that is solid gold, I would be p***ed,” another user said.

How to check if your physical Bitcoin is real

Unfortunately, the Redditor could now have a mass-produced, novelty Bitcoin on their hands as, according to Amazon, you can buy these for a measly $8.99.

However, on the flip side, APMEX is selling a 1 oz Gold Round for $2,868.59. So, it looks like the restaurant employee could equally be rolling in cash.

According to Crypto News, there are a couple of steps the social media user can take to find out the exact BTC balance of the coin

First, they should find the wallet address or QR code and then use Blockchain Explorer to verify the validity of the coin.

Then, they will need to verify whether the wallet is secure. “There should be a private key under the public wallet address,” writes the publication.

“Verify that the public wallet address looks sound and is undamaged. If the public address sticker has been removed at any point, it’s possible that someone else has the private key as well and can access the wallet’s funds.”

.webp)

.webp)

A 12-year-old decided to invest in Bitcoin and ended up becoming a millionaire.

Hindsight is a wonderful thing isn’t it? However, for Erik Finman, he certainly doesn’t need to look back with any sort of pang of regret after investing in Bitcoin at the age of 12 and going on to become a millionaire.

At the age of 12, many of us were splashing our pocket money on Pokémon cards or sweets at the local corner store, but not Erik Finman.

In 2011, instead of wasting away his pocket money, Erik decided to put his money where his mouth was after striking a deal with his parents that he’d prove he could make his fortune outside of traditional education in return for being able to skip out studying a college degree.

But how would Erik build such wealth? Well, luckily for the 12-year-old, Bitcoin had just been launched in 2009 and data became available the following year, so after receiving $1,245 from his grandmother, Erik decided to invest in the cryptocurrency.

Erik Finman giving a TED Talk aged 15 (TEDx)

At the time Erik invested, trading was at around $12 – and this gave him about 103 BTC.

While I’m sure most kids that age would have likely been lost at how he managed to invest this money on a new emerging online currency phenomenon, it certainly paid off.

In December 2017 – when Erik was just 18 – Bitcoin reached a high of around $20,000 and his initial $1,245 investment increased to a staggering $2.07 million. Not bad, eh?

Reflecting on his decision that paid off massively, as an adult Erik said ‘people didn’t really get what I was trying to do’.

He told the Business of Business: “I really didn’t like high school. People didn’t really get what I was trying to do, get what I was searching for or what I was dreaming of.

“I had one teacher tell me, yeah, drop out, work at McDonald’s since I’ll never amount to anything more in life.

.webp)

.webp)

By the time he was 18, Finman’s investments had paid off (X/@erikfinman)

“I dropped out of high school and made a bet with my parents: if I make a million dollars by the time I’m 18, I don’t have to go back to school or go to college.”

And Erik didn’t just stop after making his first million either, building the amount of Bitcoins he had to 341 – with an estimated worth of more than $4.8 million by mid 2020.