Elon Musk might be the richest person in the world now, but he’s admitted that his company Tesla came dangerously close to bankruptcy thanks to the launch of just one product.

After being founded in 2003, Tesla has gone on to become one of the most recognizable carmarkers of our time, and as of January 2025 has a market cap of $1 trillion, according to Companies Market Cap.

The company’s multiple electric car models, the divisive Cybertruck and its charging technologies have helped grow its worth, but it was actually the launch of one of its products that caused problems for Tesla beginning in 2017.

Tesla has a market cap of $1 trillion (Smith Collection/Gado/Getty Images)

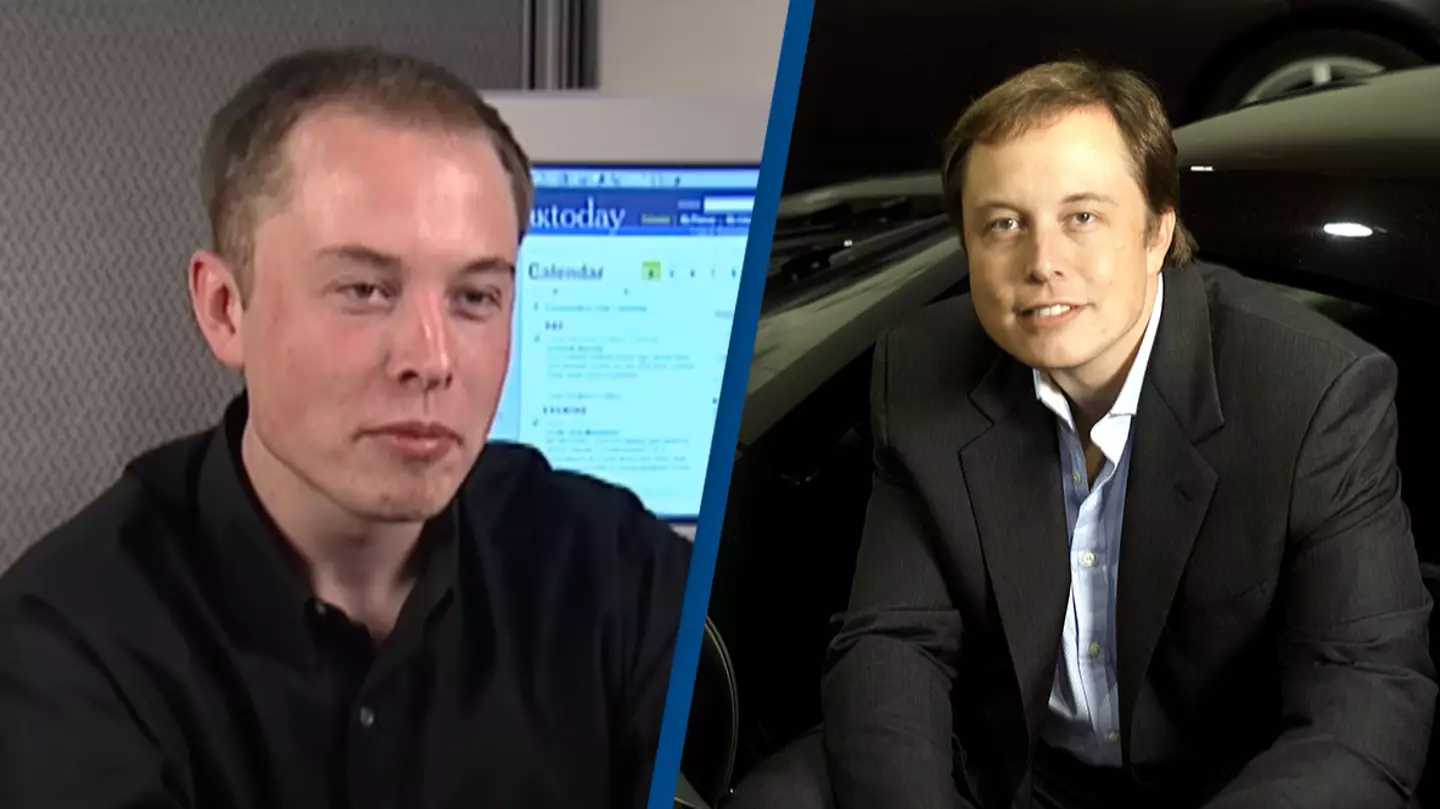

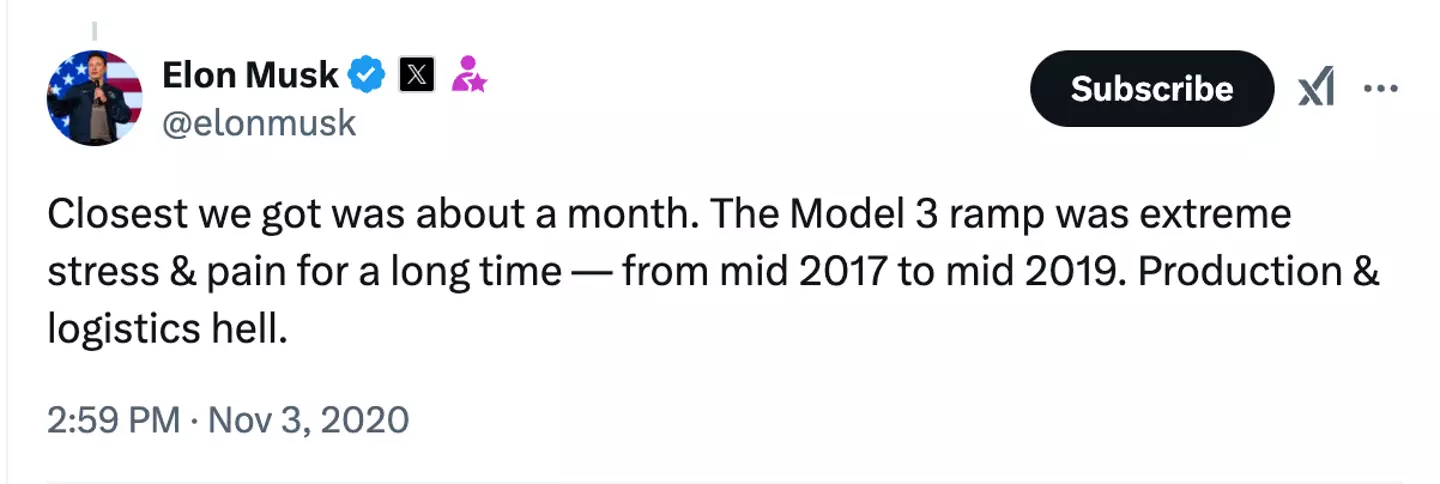

Musk admitted Tesla had been struggling in a post on Twitter in 2020, when he responded to an ‘On This Day’ post about some of Tesla’s earlier problems.

The post read: “On this day in 2008: Tesla secures $40 million loan to avoid bankruptcy. Today, it’s the most valuable automaker in the world.”

In response to the post, Musk revealed that Tesla had at one point been just one month away from complete bankruptcy.

But in spite of the challenges the company faced, Tesla managed to make it through the tough period and come out the other side.

After struggling with the production of the model, Tesla went on to open a new factory in Shanghai with initial plans to produce 150,000 Model 3s per year, before increasing output to at least 250,000 vehicles a year.

The rise of Tesla didn’t necessarily mark the end of Musk’s dances with bankruptcy, though. In November 2022, the businessman was quoted as telling Twitter employees that ‘bankruptcy [wasn’t] out of the question’ after he purchased the social media platform one month earlier.

Addressing staff via email, he wrote: “Without significant subscription revenue, there is a good chance Twitter will not survive the upcoming economic downturn. We need roughly half of our revenue to be subscription.”

Three years on, however, Twitter is still standing – even if it’s got a new name – and Musk remains the richest man in the world with a net worth of $414.2 billion, according to Forbes.

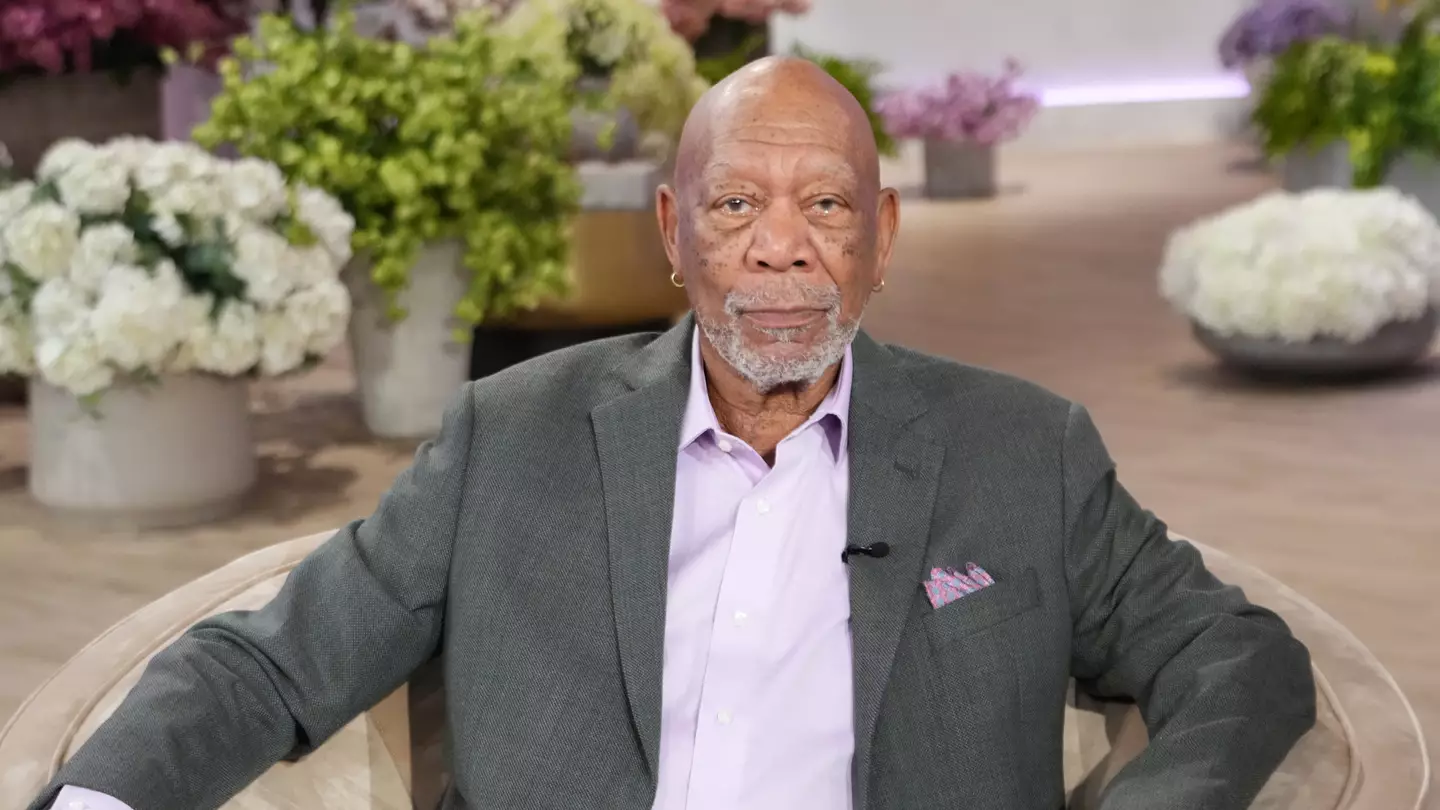

Morgan Freeman might owe a portion of his impressive fortune to Tesla stock.

The award-winning actor has reportedly racked up a net worth of $250 billion across his five-decade career. And back in 2016, the Shawshank Redemption star revealed he was an investor in the electric car company – and a ‘huge fan’ of its CEO Elon Musk.

In an interview on CNBC, the Hollywood actor sat down with Binge host Carl Quintanilla. Freeman said he sometimes checks up on the stock market while on set, confirming he owned some in Tesla.

Morgan Freeman said he was a huge fan of Elon Musk back in 2016 (Christian Marquardt – Pool/Getty Images)

“I’m a huge fan of Elon Musk. He’s got the most incredibly forward-thinking ideas about where we can go technologically,” Freeman said at the time.

Praising the tech billionaire and his cosmic exploration company SpaceX, he continued: “He’s [Musk], you know, what he’s done, nobody else has ever done,” “He’s landed a rocket ship, so it’s reusable — you know what a feat that is?”

He continued: “Now we’re taking off, and we’re going to Mars, delivering stuff to people who are going to be settling there, just like they settled the Old West, and bringing those ships back and landing them and reloading them.”

Even Musk himself acknowledged Freeman’s words.

Responding to a re-upload of the clip via X in June 2024, Musk said: “I’m a huge fan of Morgan Freeman!”

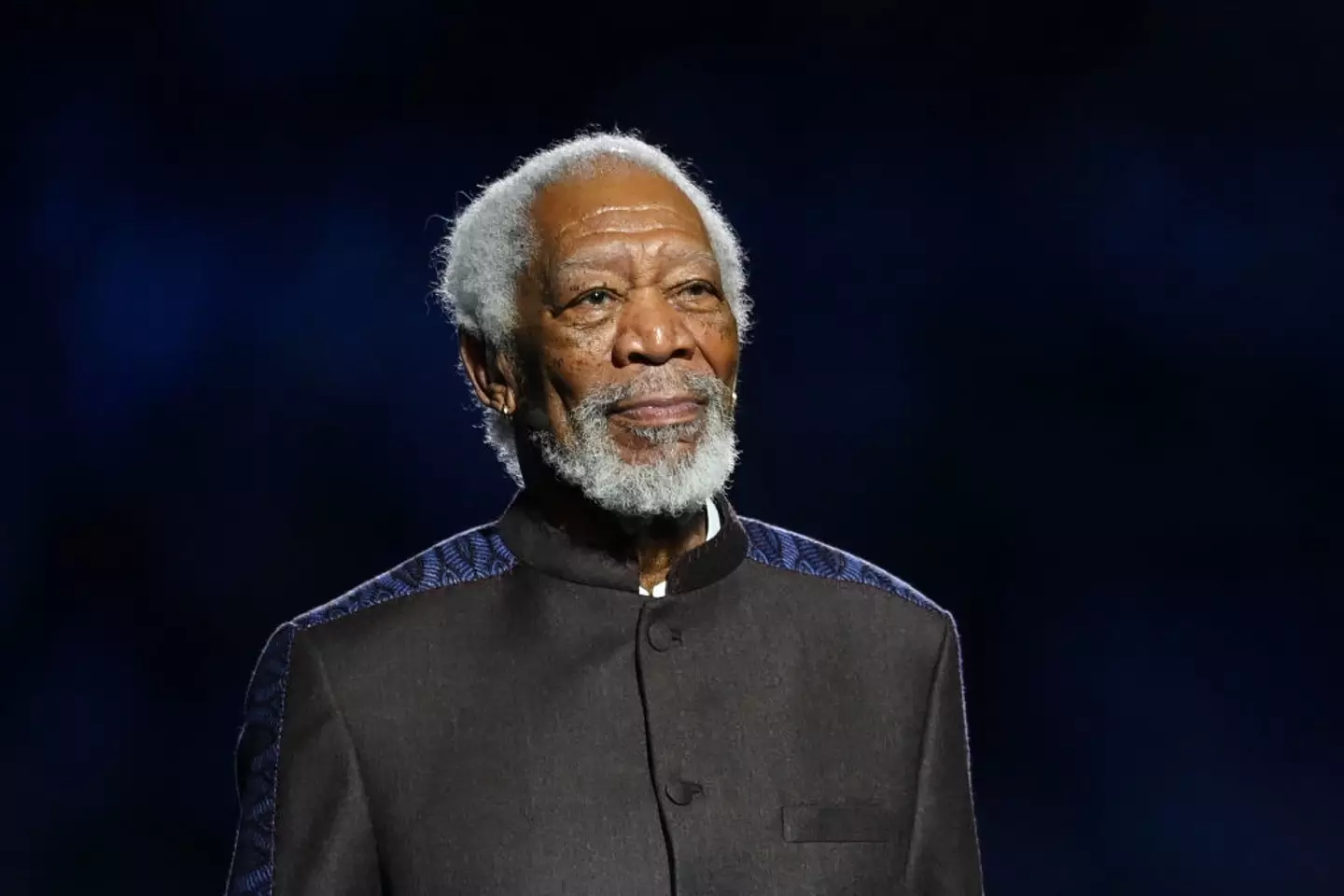

While Freeman never specified how much Tesla stock he owned or how much he bought it for, he could’ve made some series profit as Tesla has seen some major growth in the past nine years.

A lot has changed since then, and as Musk takes on a new role as head of the Department of Government Efficiency for Donald Trump’s administration, stock prices have seen a rise.

In fact, a share purchased at the time of Freeman’s CNBC interview would now be worth roughly 30 times as much.

Morgan Freeman could’ve made some serious returns on his Tesla investment (Michael Regan – FIFA/FIFA via Getty Images)

Tesla stock cost around $13.52 when the interview aired, while last week (January 24 2025), it came in at $406.58.

If Freeman had bought $10,000 worth of Tesla stock on the day of the interview and didn’t sell, he would’ve made a 3,000 percent profit, as it would today be worth $300,000.

That might be a life-changing figure to you or I, but $300,000 is only 0.12 percent of Freeman’s reported $250 million net worth.

Freeman’s publicist told Business Insider: “Mr. Freeman has a policy of not publicly discussing his personal investments.”

Tesla’s brand value has taken a $15 billion hit and Elon Musk is the reason why, analysis has shown.

The electric car company – and Elon Musk – have been making headlines for all the wrong reasons recently.

Some 5 million Teslas were called back worldwide last year, making it the most recalled automotive brand of 2024.

On top of that, a major investor sold $585 million worth of shares, once again because of the tech billionaire.

And, on the internet, people have been ripping into the controversial Cybertruck’s build quality.

Elon Musk came in as CEO of Tesla in 2008 but was an early investor when the brand was founded in 2003 (Ricky Carioti – Pool/Getty Images)

Well, analysis by research and consulting firm Brand Finance found Tesla’s brand value dropped for its second consecutive year in 2024.

It now stands at an estimated $43 billion, down from $58.3 billion at the beginning of 2024 and $66.2 billion at the start of 2023, according to the firm’s annual ranking.

Tesla’s stock price did rocket by 63 percent last year, hitting a record high in December following Donald Trump’s November election win.

But Brand Finance CEO David Haigh commented that CEO Musk – who was twice accused of making a ‘Nazi salute’ at President Trump’s inauguration on Monday – and his public antics have its downsides.

Haigh explained: “There are people who think he’s wonderful, but many that don’t.

“If you are buying electric vehicles, his persona is highly likely to impact your view of whether or not you want to buy one of his company’s cars, but that’s only one of many factors.”

The Tesla CEO has been at the center of a number of controversies (Christian Marquardt – Pool/Getty Images)

Brand Finance analyzed answers from about 175,000 survey respondents worldwide, with 16,000 people sharing their views on Tesla.

And its scores across key measurements including ‘consideration,’ ‘reputation’ and ‘recommendation’ tanked in the US, Europe and Asia, the research found.

In Europe, its ‘consideration’ score – whether people would think about buying from a brand – dropped from 21 percent to 16 percent on average from 2024 to 2025.

And in what will be a surprise to absolutely no one, Tesla maintained a high loyalty score of 90% in the US.

So, customers who already owned a Tesla vehicle ‘were likely to keep driving it over the next 12 months,’ according to CNBC.

Its US recommendation score dropped from 8.2 out of 10 to 4.3, however…

Tesla’s recommendation scores dropped in the US, despite loyalty among owners (John Paraskevas/Newsday RM via Getty Images)

Haigh said Tesla’s plummeting scores suggests the company’s ‘pulling power is weakening,’ adding there’s a risk that Tesla ‘won’t be able to sell so many products, and it won’t be able to sell at such high prices as it did before.’

He continued: “Unless Tesla can come up with a whole range of new products that will really excite consumers, and unless they can mitigate some of the antagonism caused by their leader, they will be seen as past their peak and will begin to go down.”

Elsewhere, analysts appear to view Trump’s presidency as a positive for Tesla – but an overall negative for electric vehicles.

In early January, JPMorgan estimated that about 40% of Tesla’s profits would be in danger after Trump takes office, as per Investor’s Business Daily.

This is taking into account Trump’s proposals to remove EV tax credits and subsidies.

“Tesla does not appear to us on track to dominate the global auto industry amidst the electrification transition, which we view as only the starting point for present valuation,” JPMorgan analyst Ryan Brinkman wrote.

UNILAD has reached out to Tesla for comment.

Elon Musk took a major risk when he had ‘no money’ which led him to become a millionaire at just 27 years old.

Musk, now 53, is currently the richest man in the world, with a net worth of more than $428 billion, as per Forbes.

The Tesla CEO took a punt on the internet back in the mid-90s and, boy, did it pay off.

But the tech billionaire was headed on a slightly different life path before becoming mega rich.

The South African-born entrepreneur grew up in Pretoria before moving to Canada for college.

Elon Musk is the world’s richest person (Allison Robbert-Pool/Getty Images)

He then relocated to California to attend the prestigious Stanford University after gaining a spot on their materials sciences PhD program.

But he reportedly dropped out after just two days, instead, starting up a revolutionary company with his brother, Kimbal, in 1995.

That business – called Zip2 – would change the course of their lives forever.

What was Zip2?

Zip2 was essentially a cross between the Yellow Pages and Google Maps.

It served as a searchable business directory, at a time when, well, people didn’t really believe in the internet…

In fact, Musk, his brother and their business partner Greg Kouri were forced to live in their office to cut down on costs.

Anyway, Musk managed to convince electronic map company Navteq to give him free mapping software.

Taking a business listing database, Musk then wrote the necessary code to combine that and the map, creating Zip2.

Musk said that ‘everyone ought to be able to find the closest pizza parlour and to be able to figure out how to get there’.

While Zip2 initially provided local businesses with an internet presence, it later went on to help newspapers design online city guides.

In 1999, IT company Compaq bought it out for $307 million. Musk, who was 27, kept $22 million of that.

Musk went on to co-found the company that became PayPal after selling Zip2 (Justin Sullivan/Getty Images)

That same year, he went on to co-found direct bank X.com, which merged with Confinity to form PayPal in 2000.

In 2002, Musk acquired United States citizenship, and that October eBay acquired PayPal for $1.5 billion.

He then used $100 million of the money he made from the sale of PayPal to found astronautics company SpaceX – which will help NASA to destroy the International Space Station.

Fast forward to the present day, and Musk is about to begin his role as an adviser to President-elect Donald Trump as part of the newly created Department of Government Efficiency (DOGE), which has been tasked with trimming the US federal budget.

The new department will sit outside government but will offer guidance to the Trump White House, with Musk leading it alongside former Republican presidential candidate Vivek Ramaswamy.

T

Just four days into his presidency, Donald Trump has done damage to a market that both Elon Musk and Jeff Bezos sunk major investments in.

As two of the world’s richest men, they’re used to some healthy competition – like the space race, for example, with Musk’s SpaceX attempting to rival Bezos’ Blue Origin.

But it seems neither will be benefiting as the president rolled back Joe Biden’s electric vehicle policies after being sworn into office on Monday (January 20).

Trump wasted no time in signing off a raft of executive orders, including one against transgender people, that technically makes everyone in the US female.

On the automotive front, he revoked a 2021 Biden order that demanded EVs make up 50 percent of new cars by 2030.

Musk is now part of Trump’s White House advisory team, DOGE (om Brenner for The Washington Post via Getty Images)

The president had previously agreed to end federal tax credit for EV purchases, too, which cost up to $7,500 for new zero-emission vehicles and also $4,000 for used ones.

For Tesla CEO Musk, of course, this isn’t great news.

On Tuesday, Tesla shares fell as much as three percent, with investor confidence, understandably, knocked. But confident Musk agreed that EV subsidies should end, reckoning it would only have a ‘slight’ impact on his business.

He told analysts back in July, as per Yahoo! Finance: “I guess that there would be, like, some impact, but I think it would be devastating for our competitors and for Tesla slightly.

“But long term probably actually helps Tesla, would be my guess, yes … the value of Tesla overwhelmingly is autonomy.”

Tesla’s stock price fell sharply the day after Trump’s inaugaration (Sean Gallup/Getty Images)

Interestingly, Musk is also part of Trump’s Department of Government Efficiency (DOGE), which is tasked with advising the White House to slash ‘federal spending.’

Tesla’s stock wasn’t the only one feeling the pinch on Tuesday, as EV charging company EVgo and Tesla rival Rividian also saw a drop in share prices.

And this too spells trouble for Amazon founder Bezos.

The billionaire is a major investor in Rivian, a company that began trading in 2009, some six years after Tesla began its journey as Tesla Motors in 2003.

According to some reports, Amazon owns a stake of up to 15 percent stake in Rivian after apparently investing $700 million into its car making plans.

Rivian received billions of dollars of funding from Joe Biden’s government (Phillip Faraone/Getty Images for Rivian)

The company reportedly received a $6.6 billion loan from Biden’s government only a mere two months ago and recently partnered with Volkswagen to produce an electric Ford backed by Biden.

But a flurry of obstacles – including supply chain issues and high interest rates – saw its production rate slow down.

However, analysts last year predicted Rivian’s growth could ‘accelerate over the next three years,’ with plans to launch a ‘cheaper’ R2 SUV in 2026 and two higher-end RVs by 2027.